Strata Corporation Finances (22:VIII): Difference between revisions

No edit summary |

|||

| Line 1: | Line 1: | ||

{{REVIEWED LSLAP | date= July | {{REVIEWED LSLAP | date= July 30, 2024}} | ||

{{LSLAP Manual TOC|expanded = strata}} | {{LSLAP Manual TOC|expanded = strata}} | ||

Latest revision as of 17:46, 6 August 2024

| This information applies to British Columbia, Canada. Last reviewed for legal accuracy by the Law Students' Legal Advice Program on July 30, 2024. |

A. Introduction to Strata Corporation Finances

A strata corporation collects funds from the owners to fulfill many of its duties. Funds are collected and allocated to the strata corporation’s operating fund, contingency reserve fund, or a special levy fund. The funds are spent in accordance with the authority granted at an annual or special general meeting and within the confines of the SPA and the SPR.

B. Operating Fund

1. Purpose of Operating Fund

Each strata corporation must establish an operating fund (SPA, s 92) to be used for common expenses that occur either once a year or more often than once a year. Examples include landscaping, management fees, annual inspection fees, and office and administrative expenses.

a) Common Expenses

Under section 1(1) of the SPA, “common expenses” is defined as those expenses:

- Relating to the common property and common assets of the strata corporation; or

- Required to meet any other purpose or obligation of the strata corporation.

b) Strata Fees

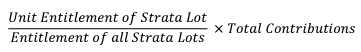

To create the operating fund, each owner contributes fees that are determined by reference to the budget approved at the annual general meeting. These fees are generally a strata corporation’s primary source of income. The default formula to calculate strata fees is set out in section 99:

Per section 107(1), interest can be charged by bylaw on late payments so long as the rate of interest does not exceed what is set out by the SPR, which is currently 10% per annum, compounded annually.

2. Approval Requirements

Section 13(1) of the SPA requires the owner developer to prepare an interim budget for the strata corporation for a 12-month period beginning on the first day of the month following the month in which the first conveyance of a strata lot to a purchaser occurs. This interim budget must include:

- The estimated operating expenses of the strata corporation for the 12-month period;

- The contribution to the operating fund for the 12-month period, which must be at least 5% of the estimated operating expenses;

- Each strata lot’s monthly share of the expenses calculated by the formula in section 99.

For every fiscal period following the first annual general meeting, a strata corporation must prepare a budget for the coming fiscal year (s 103(1)), which is to be distributed with the notice of the annual general meeting in accordance with section 45 and approved by a resolution passed by a majority vote at each annual general meeting. If a budget is not approved at an annual general meeting, a subsequent special general meeting must be held to approve a budget (s 104).

The budget must include the following information (SPR, s 6.6(1)):

- The opening balance in the operating fund and the contingency reserve fund;

- The estimated income from all sources other than strata fees, itemized by source;

- The estimated expenditures out of the operating fund, itemized by category of expenditure;

- The total of all contributions to the operating fund;

- The total of all contributions to the contingency reserve fund;

- Each strata lot’s monthly contribution to the operating fund;

- Each strata lot’s monthly contribution to the contingency reserve fund;

- The estimated balance in the operating fund at the end of the fiscal year; and

- The estimated balance in the contingency reserve fund at the end of the fiscal year.

3. Amendment of Budget

Before the budget is put to vote at an annual general meeting, the proposed budget may be amended by majority vote of the owners at the meeting (s 103(4)). There is nothing in the SPA that allows for amendments to the budget after it is approved at the annual general meeting, although the CRT suggested at para 64 in Gulf Manufacturing Ltd v The Owners, Strata Plan BCS 1348, 2019 BCCRT 16 that a special general meeting could be called and a revised budget could be approved.

4. Failure to Approve Budget

If the proposed budget is not approved by a majority vote at an annual general meeting, the strata corporation must prepare a new one within 30 days and place it before a special general meeting for approval by a resolution passed by a majority vote, unless a longer period was approved by a resolution passed by a ¾ vote at the annual general meeting (s 104(1)). If the fiscal period ends before a new budget is approved, the previous budget continues in effect.

5. Operating Fund Expenditures Not Approved in the Budget

If an expenditure is not in the budget, it can be made from the operating fund if it is approved by a resolution passed by a ¾ vote at an annual or special general meeting (s 97(b)) and complies with section 98. The total amount of unapproved expenditures must be:

- Less than the amount set out in the strata corporation’s bylaws; or

- If the bylaws are silent, the lesser of

- i) $2,000, or

- ii) 5% of the total contribution to the operating fund of the current year.

Section 98 also allows for “emergency”-type expenditures (s 98(3)) if there are reasonable grounds to believe that an immediate expenditure is necessary to ensure safety or prevent significant loss or damage, including imminent legal issues with a risk of causing financial loss. The strata corporation must inform owners as soon as feasible about any expenditure of this type being made (s 98(6)).

6. Surpluses and Deficits

Unless accrued in the period before the first annual general meeting or otherwise determined by a resolution passed by a ¾ vote at an annual or special general meeting (s 105(1)), a surplus (actual expenses are less than contributions to the operating fund) must be dealt with in one or more of the following ways:

- Transferred into the CRF;

- Carried forward as part of the operating fund as a surplus;

- Used to reduce the total contribution to the next fiscal year’s operating fund.

For surpluses accruing during the period before the first annual general meeting, the strata corporation must refund the surplus to the strata lot owners in amounts proportional to their contributions, unless no strata lot owner is entitled to receive more than $100 in total (s 14(6)), then the surplus can be deposited in the CRF (s 14(7)).

Unless accrued in the period before the first annual general meeting, the strata corporation must eliminate the deficit during the next fiscal year (s 105(2)) by one of the following ways:

- Transferred from the CRF, provided the transfer is approved by a ¾ vote;

- Increasing strata fees to include payment towards the deficit;

- Assessing a special levy against the strata lot owners to eliminate the deficit, provided that the strata corporation approves the levy by a ¾ vote.

For deficits accrued during the period before the first annual general meeting, the owner developer must pay the difference to the strata corporation within eight weeks of the first annual general meeting (s 14(4)). If the actual expenditures for this period before the first annual general meeting exceed budget expenditures by between 10 and 20%, the owner developer must pay twice the actual deficit to the strata corporation, and if the expenditures exceed the budget by more than 20%, the owner developer must pay three times the actual deficit to the strata corporation (s 14(5)).

7. Interfund Transfers

Funding can be transferred from one fund to another is they are included in the approved budget or were approved by a resolution that was passed by a ¾ vote at a general meeting. Transfers from the CRF must be approved by a ¾ vote resolution unless (SPR, s 6.3):

- The loan is repaid by the end of that fiscal year of the strata corporation; and

- The loan is for the purpose of covering temporary cash flow shortages as described in the provision.

8. User Fees and Other Income

Other than strata fees, a strata corporation may have other sources of income that include user fees, interest income, rental income, and fines, and more.

User fees cannot be collected from the strata corporation for the use of common property or common assets unless, per section 6.9 of the SPR, the fee is objectively reasonable and set out in a bylaw or rule that has been ratified by majority vote at an annual or special general meeting. For example, in Cody Watson v Strata Plan BCS 1721, 2017 BCCRT 10 (later affirmed on appeal) the CRT found that a $100 moving fee was unreasonable for residents moving without any furniture. However, in Malin v Strata Plan VR 1543, 2022 BCCRT 439, the CRT found a lack of evidence demonstrating that a $150 move-in fee was unreasonable since the owner could not adduce any objective evidence about market conditions or the costs incurred by the strata in facilitating moves into the building.

Interest earned on money held on a special levy or CRF form part of their respective funds (ss 95(3) and 108(7)).

C. Special Levies

1. Approval and Form of Resolution

A special levy is money collected from strata lot owners for a specific purpose and for shared common expenses. Strata corporations may raise money from the strata lot owners by means of a special levy (SPA, s 108(1)) as long as it is approved by the owners by way of a resolution passed at an annual or special general meeting. A special levy that is calculated using the formula in section 99 of the SPA or a different formula that meets section 100 of the SPA must be passed by a ¾ vote at an annual or special general meeting (s 108(2)(a)).

If the corporation is unable to approve a special levy resolution to effect repairs and maintenance that are necessary to ensure safety or prevent significant loss of damage, section 173(2) allows a strata corporation to apply to the Supreme Court for an order to approve the special levy resolution. There is no need to prove that the repairs are “crucial” or the threat of loss or damage is “immediate” (The Owners, Strata Plan VIS 114 v John Doe, 2015 BCSC 13).

2. Purpose of Special Levies

The special levy must be used only for the specific use stipulated in the resolution that approved the special levy. A special levy is useful in that it gives the strata corporation the ability to undertake expenses that cannot be funded from the either the operating fund or the CRF.

3. Reporting Requirements

A strata corporation must inform the strata lot owners about the expenditure of the funds collected by way of special levy and any interest earned on the special levy (s 108(4)(d) and (7)). The funds can only be invested in investments permitted by the SPR or insured accounts with savings institutions in British Columbia, or both (s 108(4)(b)).

4. Payment When Strata Lot Sold

If a special levy is approved before a strata lot is conveyed to a purchaser, section 109 of the SPA provides that:

- The person who is the owner of the strata lot immediately before the date the strata lot is conveyed owes the strata corporation the portion of the levy that is payable before the date the strata lot is conveyed, and

- The person who is the owner of the strata lot immediately after the date the strata lot is conveyed owes the strata corporation the portion of the levy that is payable on or after the date the strata lot is conveyed.

In Day v The Owners, Strata Plan VR 320, 2022 BCCRT 11, the CRT found that the SPA does not entitle strata corporations to retroactively apply special levies and thereby make former owners responsible for paying them.

5. Disposition of Surplus Funds

Funds that are surplus from a special levy must be paid to each strata lot owner the portion of the unused amount proportional to the contribution made to the special levy in respect of that strata lot (s 108(5)). If no strata lot owner is entitled to receive more than $100, the strata corporation can instead deposit the total surplus funds into the CRF (s 108(6)). If the owner is new, Gaudin v The Owners, Strata Plan LMS 2140, 2020 BCCRT 607 confirmed that it is the strata lot owner at the time the refund is made that is entitled to receive the refund.

D. Borrowing by Strata Corporation

The strata corporation may borrow money required to exercise its powers and perform its duties after approval by a resolution passed by a ¾ vote at an annual or special general meeting (SPA, s 111). A strata corporation can lend money from its CRF to the operating fund (s 95(4)) if the amount is repaid by the end of the strata corporation’s fiscal year and the loan is used for the purpose of covering temporary shortages in the operating fund (SPR, s 6.3).

E. Contingency Reserve Fund

The contingency reserve fund (CRF) is the fund established by the strata corporation to meet its obligations to pay for common expenses that occur less often than once a year or that do not usually occur (ss 1 and 92).

1. Annual Budget Contributions

Effective November 1, 2023, the amount of the annual contribution to the CRF for the fiscal year following the first general meeting must at least 10% of the total amount budgeted for the contribution to the operating fund for the 12-month period covered by that budget (SPR, s 3.4).

The amount of the annual contribution to the CRF for any other fiscal year must be determined after consideration of the most recent depreciation report, if any, obtained under section 94 of the SPA, and must be at least 10% of the total amount budgeted for the contribution to the operating fund for the current fiscal year (SPR, s 6.1).

2. Capital Planning and Depreciation Reports

Depreciation reports tell a strata corporation what common property and assets it has and what are the projected maintenance, repair, and replacement costs over a 30-year time span. These reports help assist strata corporations plan for major expenses and plan when to use their contingency reserve fund.

It is mandatory for most strata corporations to obtain a first depreciation report (s 94) and subsequent depreciation reports no later than three years after the date of the strata corporation’s previous report (s 94(2)). Strata corporations consisting of fewer than five strata lots are exempt (s 94(3)). Effective July 1, 2024, strata corporations may no longer hold an annual ¾ vote to waive or defer getting a depreciation report: see Strata Depreciation Report Requirements.

Depreciation reports must be prepared by a “qualified person” (s 94(1)) defined in section 6.2 of the SPR as: “a person who has the knowledge and expertise to understand the individual components, scope and complexity of the strata corporation’s common property, common assets and those parts of a strata lot or limited common property, or both, that the strata corporation is responsible to maintain or repair”. Effective July 1, 2024, this “qualified person” must either be an engineer, architect, applied science technologist, accredited appraiser, certified reserve planner, or a quantity surveyor as qualified by section 6.2 of the SPR.

Other requirements and standards of depreciation reports can be found in section 6.2 of the SPR.

Depreciation reports can also be significant in evaluating the financial and physical condition of a strata corporation. Sections 35(2)(n.1) and 36(1) of the SPA allow strata lot owners and those persons authorized in writing by an owner to obtain and inspect copies of depreciation reports. Section 59 of the SPA requires that a copy of the most recent depreciation report be attached to Information Certificates, which are routinely requested by prospective purchasers of strata lots.

3. Approval of Expenditures

There are exceptions to the rule in section 96 that permit expenditures to be made from the CRF only if they are first approved by a resolution passed by a ¾ vote at an annual or special general meeting. A majority vote can be sufficient if the expenditure is necessary to obtain a depreciation report under section 94 or related to the repair, maintenance, or replacement of common property or common assets that is recommended in the most recent depreciation report. In addition, if there are reasonable grounds to believe an immediate expenditure is necessary to ensure safety or prevent significant loss or damage, the expenditure can be made out of the CRF is the expenditure is for a common expense that occurs less often than once a year or does not normally occur (s 98(3)) and the expenditure does not exceed the minimum amount needed to ensure safety or prevent significant loss or damage (s 98(4)).

F. Electrical Planning Reports

Under section 94.1 of the SPA, strata corporations with more than five lots must obtain an electrical planning report, which assists with planning future electrical needs and upgrades. A key purpose of these reports is to plan for anticipated increases in electric car charging and heat pump use. Section 5.8 of the SPR mandates the acquisition of an electrical planning report by December 31, 2026 for strata corporations located in the Fraser Valley Regional District, the Capital Regional District, and the Metro Vancouver Regional District, except for any islands within those districts that can only be accessed by air or boat. For all other locations, electrical planning reports must be acquired by December 31, 2028. Strata corporations established after December 31, 2023 with more than five strata lots must obtain an electrical planning report on or before the date that is five years after the date of the deposit of the strata plan.

Electrical planning reports must include all of the information listed in section 5.11 of the SPR, including the current capacity of the strata corporation’s electrical system and a list of existing demands on the electrical system. The report must be made by a “qualified person” as defined by section 5.10 of the SPR. These reports must be attached to Information Certificates requested by prospective buyers.

G. Allocating Expenses

1. Two Main Issues with Allocating Expenses

a) Unit Entitlement or Not

Generally, all owners must contribute to the costs of repair and maintenance in accordance with unit entitlement, as decided by the courts in Owners, Strata Plan LMS 1537 v Alvarez, 2003 BCSC 1085.

b) Everyone, or Allocate to Individuals

There are, however, exceptions in which common expenses are allocated using a different formula than the formula in section 99 (s 100(1)). For example, certain common expenses that relate to and benefit only limited common property can be allocated to only those strata lot owners entitled to the use of that limited common property. If different “types” of strata laws are distinguished by the bylaws, common expenses that relate to and benefit a particular type of strata lot can be allocated to only the strata lots of that type.

2. Unit Entitlement

a) Relating to Owners

“Unit Entitlement” is the number used in calculations to determine the strata lot’s share of common property, common assets, common expenses, and common liabilities of the strata corporation (s 1(1)). The SPA and the SPR require the calculation of contributions to the operating fund, the contingency reserve fund, and a special levy to be based on unit entitlement. Otherwise, if a strata corporation has failed to calculate contributions to the operating fund in accordance with unit entitlement, the owner may be able to obtain an order from the CRT requiring the corporation to determine the correct strata fee calculations.

b) Relating to Limited Common Property

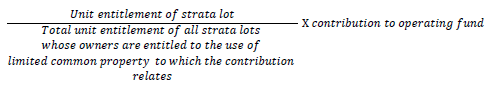

Provided there is no alternate formula adopted by way of a section 100 resolution, the SPR allows for the formula in section 99 to be amended for operating fund expenses that relate to and benefit only limited common property as follows:

That formula cannot be used for contributions to the contingency reserve fund and special levies. Instead, the contributions are allocated among all of the owners as follows:

3. Section 100 Resolutions

Section 100 of the SPA allows a strata corporation to adopt a different formula than the default one set out in section 99 if such is approved by a resolution passed by a unanimous vote after the first annual general meeting (s 100(1)).

a) Operating Fund

Section 100 resolutions can provide an alternate formula for the entire operating fund, such that no expenses outlined in the budget are apportioned by unit entitlement, or for only certain expenses from the operating fund. Courts can also impose section 100 resolutions, like in Shaw v The Owners Strata Plan LMS 3972, 2008 BCSC 453 when the court found unit entitlement allocation of expenses to be significantly unfair due to the strata corporation consisting of two sections, residential and commercial.

b) Contingency Reserve Fund

Similarly, section 100 resolutions can apply to either all contributions to the CRF or only with respect to certain expenses. Section 100 resolutions can allocate expenses relating to limited common property to only those strata lot owners that have exclusive use of the limited common property, and section 100 resolutions can allocate expenses that would benefit specific types of strata lots to only strata lots of that particular type.

c) Special Levies

Section 100 resolutions may also apply to special levies under section 108(2)(a) of the SPA. This suggests that if all common expenses are subject to an alternate formula under section 100, the contribution to a special levy, by default, will be allocated in the same way. However, section 100 itself does not refer to special levies.

Section 108(2)(b) provides a similar mechanism to a section 100 resolution. If there is another way that establishes a fair division of expenses for a particular special levy, the strata corporation may use that alternate division, but in order to do so, the special levy must be approved by a resolution passed by unanimous vote at an annual or special general meeting.

| © Copyright 2024, The Greater Vancouver Law Students' Legal Advice Society. |